wienerberger Equity Story

For more than 200 years, our mission at wienerberger has been clear: improving people’s quality of life through our smart building material and infrastructure solutions. With our durable and sustainable products for new build, renovation, and infrastructure, we are perfectly positioned to further improve our ecological performance by contributing to the fight against climate change and to shape the future of construction through innovation. wienerberger has been listed on the Vienna Stock Exchange since 1869 and is a pure free float company with 100% of its shares being publicly traded.

Why invest in wienerberger?

Strong commitment to ESG

- Innovative Solutions for Net Zero Buildings: We provide solutions for net zero buildings through our sustainable materials for the building envelope and advancements in water and energy management. Our goal is to achieve 75% of total revenue from products contributing to net zero buildings by 2026.

- Energy-Efficient Products for Climate Action: Our energy-efficient products contribute to combating climate change. Our innovative infrastructure solutions ensure sustainable use of resources such as water. With exceptional quality and a lifespan exceeding 100 years, our products are designed for durability and recyclability, supporting our circular economy goals of achieving over 80% sales from highly durable products and over 90% from recyclable or reusable products by 2026. At the same time, the use of our products helps our customers reduce their own carbon footprint.

- Focused on Key Sustainability Areas: At wienerberger, we also concentrate on preserving biodiversity, reducing our own CO₂ emissions, and enhancing water and waste management ensuring a long-lasting positive impact on the environment.

- Supporting Communities in Need: People are at the heart of our operations. Each year, we actively support initiatives to provide housing solutions for people in need within our local markets, contributing to community well-being and social resilience.

- Commitment to Transparency and Governance: As a company with 100% free float, we maintain open dialogue with our investors and adhere to the highest international governance standards.

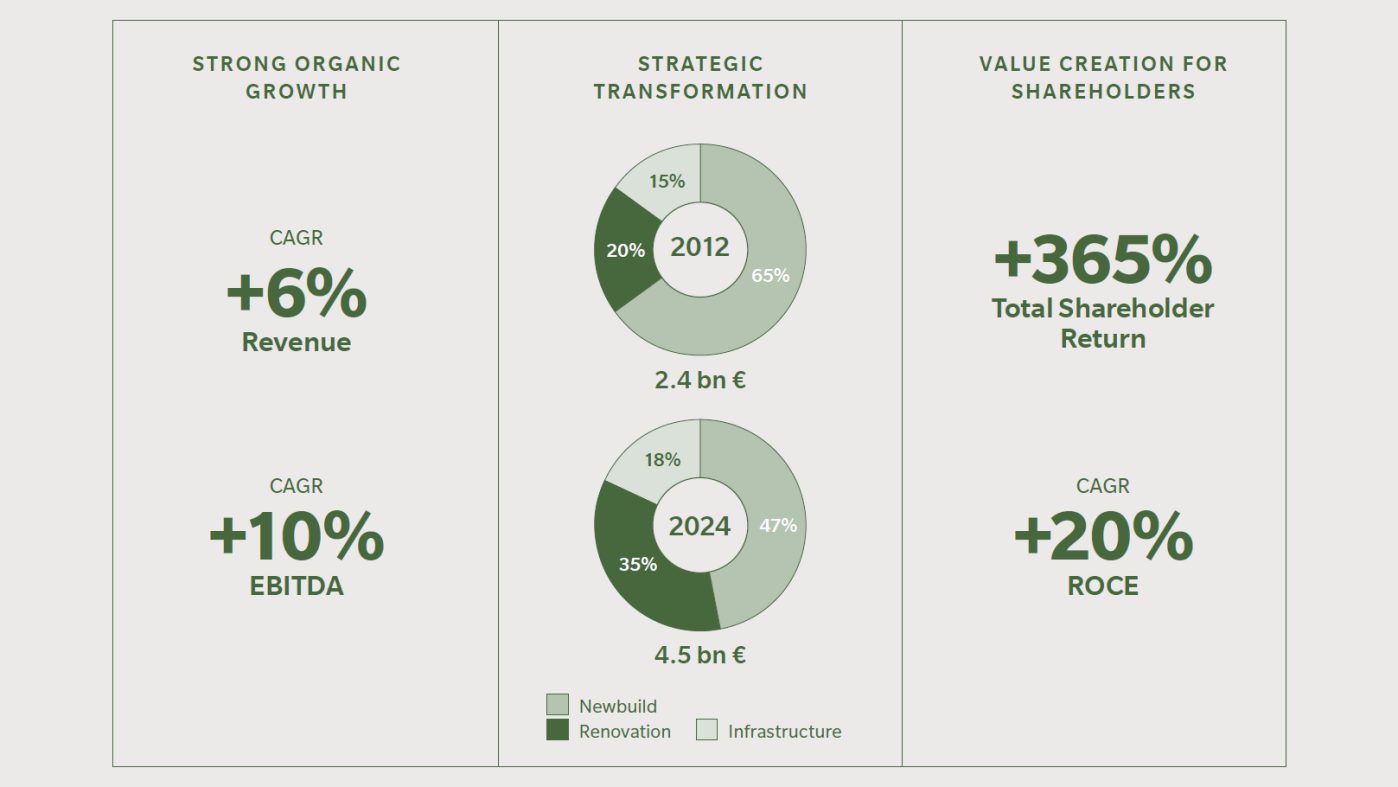

Added value for our shareholders through stable earnings growth

With a clear strategic focus and a proven track record of delivering strong growth rates, EBITDA margins, and cash flows, we continuously aim to generate added value for our stakeholders. We therefore concentrate on three core areas:

- Organic growth through innovation

As a leading provider of smart solutions, wienerberger drives organic growth through innovation and digitalization. By continuously enhancing our portfolio of products and solutions, we deliver greater value to our customers while strengthening the company’s overall value creation. In 2024, the share of innovative products reached 33%, reflecting our strong focus on continuous innovation and value-added solutions.

Share of innovative products >35% until 2026

- Higher earnings through Operational Excellence

We implement efficiency-enhancing measures along our entire value chain, from procurement and production to sales and administration. Through our self-help program, we consistently improve performance, building a strong foundation for long term operational excellence. In 2024, these efforts resulted in € 41 million in savings, demonstrating our commitment to continuous efficiency improvements.

Improved efficiency: € 100 mn EBITDA contribution in 2024 – 2026

- External Growth through M&A

Given our low gearing and our strong cash flow generation, we are well-equipped to grow through acquisitions and are evaluating a highly attractive deal pipeline. This will result in further growth in our core markets in Europe and North America. The most recent acquisitions in our European and North American core markets achieve an average weighted EV/EBITDA multiple of approx. 5x after synergies, measured three years post-merger. This reflects the value created by efficiently integrating the acquired companies into our existing portfolio.

Strong M&A Track Record: ~ 5x EV / EBITDA multiple 3 years post-merger and including synergies

Resilience through diversification

- Market Leadership and Strong Brands: With a robust presence in almost 30 countries, wienerberger holds leading market positions across Europe and North America. Our portfolio of strong brands and experienced local management teams positions us as a trusted partner, fostering close relationships with key decision-makers.

- Extensive Industrial Footprint and Operational Excellence: Operating more than 200 state-of-the-art production facilities, we ensure optimal market coverage and responsiveness to customer needs. Our efficient overhead structures and commitment to operational excellence drive superior contribution to margins, even amidst constrained volumes.

- Diversified and Resilient Business Model: Our strategic focus spans new build, renovation, and infrastructure projects, enabling us to effectively navigate and balance varying business cycles across our diverse markets.

Proven Resilience Amidst Global Challenges: Our business model’s resilience has been demonstrated through geopolitical challenges and market fluctuations. By optimizing cost structures and implementing Self-Help initiatives, we have consistently maintained strong profitability and operational stability, ensuring continued value creation for our stakeholders.

STRONG ORGANIC GROWTH AND VALUE CREATION FOR SHAREHOLDERS IN 2012 – 2024

© md3d - Adobe Stock

© md3d - Adobe Stock

© ©joyfotoliakid - stock.adobe.com

© ©joyfotoliakid - stock.adobe.com

© Pipelife/Shutterstock

© Pipelife/Shutterstock