wienerberger Shares

Wienerberger AG has been successfully represented on the Vienna Stock Exchange for more than 150 years. Learn more about the price of shares, key figures and the shareholder structure.

wienerberger on the stock exchange

With a market capitalization of € 2,992 million and a weighting of 5.2% in the ATX at the end of 2024, wienerberger is one of the six largest listed companies in Austria. Wienerberger AG is listed on the prime market with 109.5 million bearer shares. The principle of “one share, one vote” applies to the publicly owned, free float shares: There are no preference or registered shares, and no restrictions apply to ordinary shares. In the US, Wienerberger AG is traded on the OTC Market through a level 1 ADR programme provided by the Bank of New York Mellon. In each case, five ADRs document the right to obtain bearer shares.

- Shares: Purely publicly owned shares, 100% free float

- Quantity: 109,497,697 no-par value shares

- Listing: Vienna Stock Exchange (WIE), Thomson Reuters (WBSV.VI), Bloomberg (WIE AV)

- Market segment: Prime market

- ADR: ADR Level 1 (WBRBY)

- ISIN: AT0000831706

Latest Information

Share Buyback Programs

Share Buyback Programs 2024

The Managing Board of Wienerberger AG was authorized by the 155th Annual General Meeting on May 7, 2024, to take the following steps (pursuant to sect. 65 para. 1(8) of the Austrian Stock Corporation Act): During a period of 30 months, the Managing Board can buy back shares of the Company to the legally permitted maximum extent, at a lowest equivalent of € 1.00 per share and a highest equivalent per share which must not exceed 20% of the average unweighted closing price of the preceding ten trading days before the respective repurchase of shares.

Repurchased shares may be cancelled or sold without a further resolution of the Annual General Meeting, and may be disposed in a way other than via the stock exchange or through public offering.

Share Buyback Program 2023

Share Buyback Program 2022

Share Buyback Programs 2020 – 2006

Use of Treasury Shares

2025 – Use of 23,343 Treasury Shares

2024 – Use of 4,489 Treasury Shares

2024 – Use of 31,023 Treasury Shares

2024 – Use of 6,000,000 Treasury Shares

2023 – Use of 6,099 Treasury Shares

2023 – Use of 387,440 Treasury Shares

Placement of Treasury Shares through Accelerated Bookbuilding Procedure 2021

The Managing Board of Wienerberger AG (FN 77676f; the "Company") announced that 2,500,000 treasury shares (ISIN AT0000831706), i.e. 2.2% of the Company's share capital, were successfully placed with institutional investors by means of an accelerated private placement (accelerated bookbuilding). The sale price per share amounts to EUR 32.50, gross sale proceeds total approx. EUR 81.25 million. The resale program for treasury shares published by Wienerberger AG on 23 July 2021 is therefore closed as of the end of 3 September 2021 (Closing). Further information can be found below.

Capital Decrease

Capital Decrease 2025

Capital Decrease 2022

Coverage by analysts

Wienerberger AG is currently covered by 10 analysts, with an average target price of EUR 33.6.

Last update: 09.12.2025

| Institution | Location | Contact | Phone |

|---|---|---|---|

| Barclays | London, UK | Pierre Rousseau | +33 144583377 |

| Berenberg | London, UK | Harry Goad | +44 7966 946737 |

| Citigroup | London, UK | Ephrem Ravi | +44 2079862462 |

| Erste Group | Vienna, AT | Michael Marschallinger |

+43 50100179 06 |

| Morgan Stanley | London, UK | Cedar Ekblom | +44 2074254623 |

| ODDO BHF | Vienna, AT | Markus Remis | +43 1 2531216601 |

| On Field Research | London, UK | Yassine Touahri | +44 2039500897 |

| RBI | Vienna, AT | Gregor Koppensteiner | +43 1717077533 |

| UBS | London, UK | Julian Radlinger | +44 2079016558 |

| Wiener Privatbank | Vienna, AT | Nicolas Kneip | +43 153431222 |

Consensus

The following consensus reflects the updated estimates of our analysts in connection with our Q1-3 2025 earnings release on November 13, 2025.

Last update: 26.01.2026

2025

| in € mn | Revenues | Operating EBITDA | EBIT | Net income | EPS | Dividend |

|---|---|---|---|---|---|---|

| Consensus Mean | 4,639 | 750 | 379 | 213 | 1.96 | 0.88 |

| High | 4,696 | 763 | 413 | 258 | 2.33 | 1.00 |

| Low | 4,588 | 736 | 359 | 181 | 1.68 | 0.65 |

| Number of estimates | 8 | 8 | 8 | 8 | 8 | 8 |

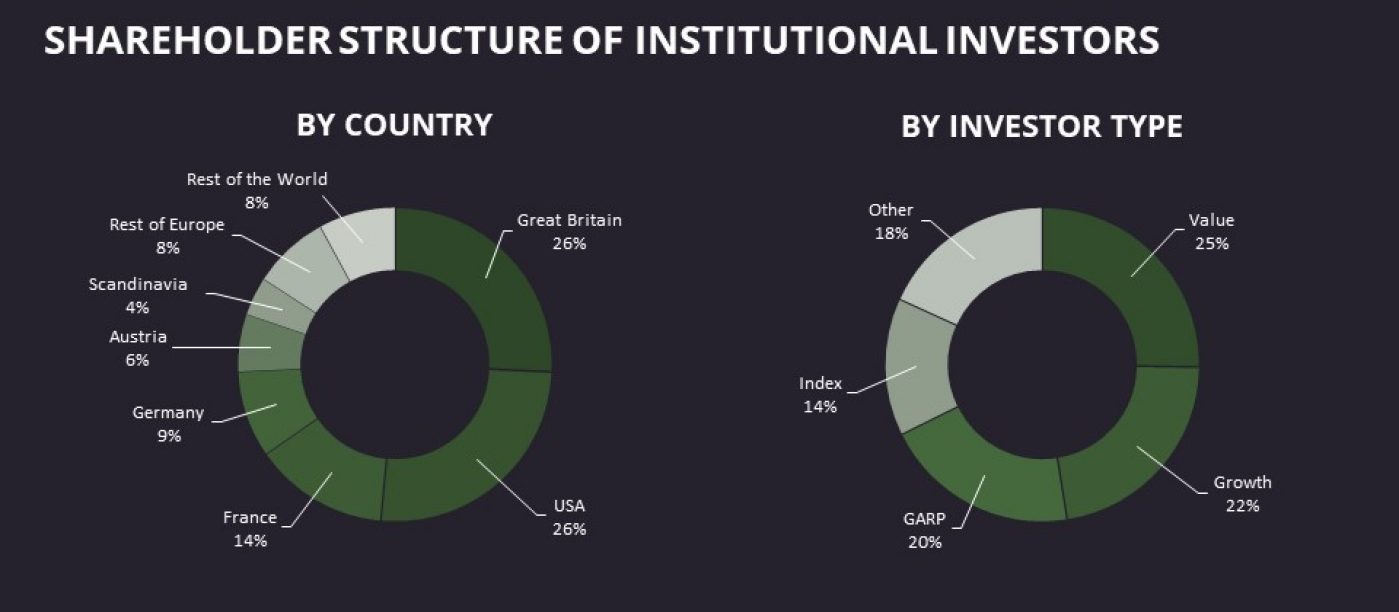

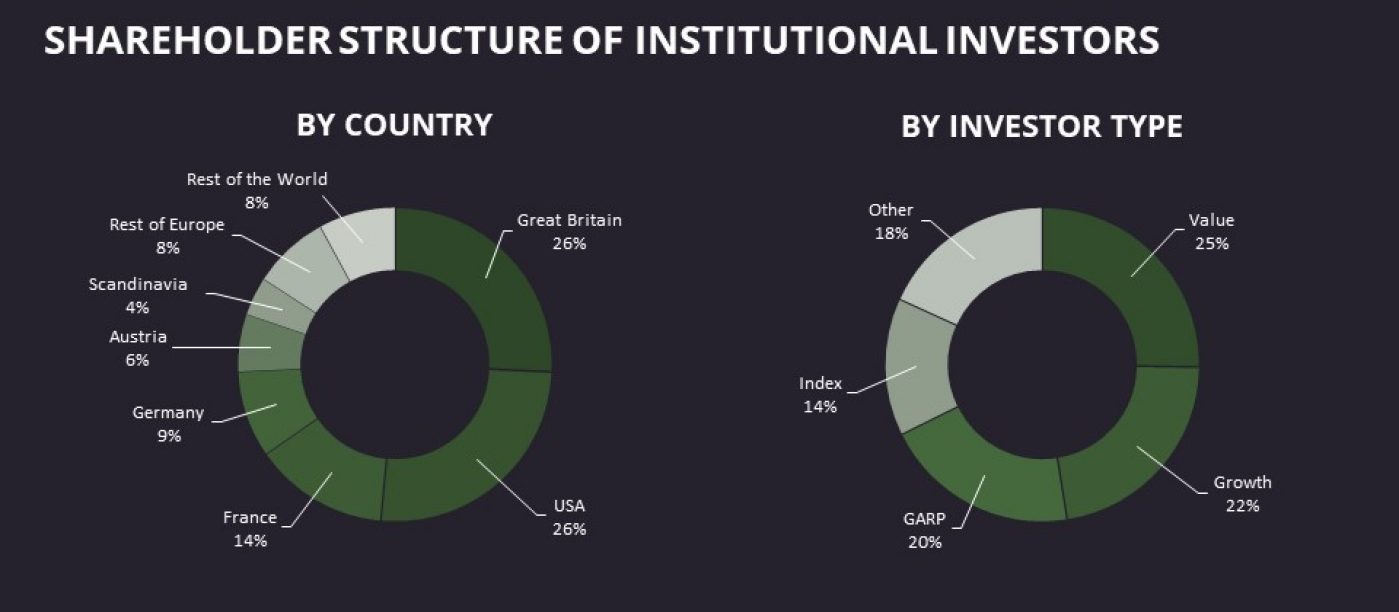

wienerberger’s shareholder structure

wienerberger is a pure free float company and has no core shareholder. 100% of its shares are publicly traded. The Group’s widely diversified shareholder structure is typical of a publicly traded company with international operations. The most recent survey of the shareholder structure performed in November 2024 showed that 15% of wienerberger shares are held by private investors. The large majority of shares are held by institutional investors, more than half of them based in the US and Great Britain (each accounting for 26%). The remaining shares are held mainly by Continental European investors.

Major holdings pursuant to Sec. 130 – 134 BörseG 2018

| Shares* | Shareholder |

|---|---|

| More than 5 % |

FMR LLC (Fidelity), USA |

| More than 5 % | Marathon Asset Management Limited, UK |

| More than 4 % | BlackRock, Inc., USA |

| More than 4 % | Erste Asset Management GmbH |

| More than 4 % | Lansdowne Partners (UK) LLP |

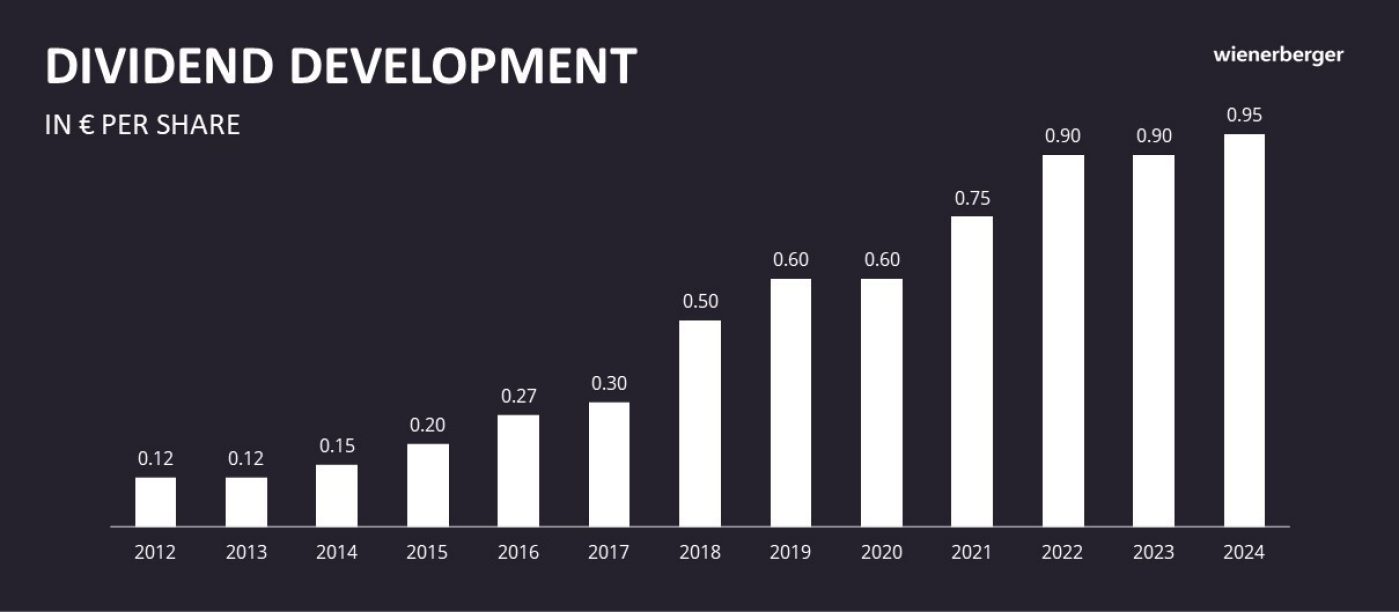

Dividend

wienerberger has defined clear conditions for dividend payouts. We are planning a dividend payout of 20 to 40% from our free cash flow, after deducting the costs of the hybrid capital. The yearly dividends are determined by taking the business’ development, the economic climate, as well as potential growth projects into consideration.

© md3d - Adobe Stock

© md3d - Adobe Stock

© Rainer Berg; Westend61

© Rainer Berg; Westend61

© ©joyfotoliakid - stock.adobe.com

© ©joyfotoliakid - stock.adobe.com